Please refer to important disclosures at the end of this report

1

Aether Industries Limited (AIL) was incorporated on January 23, 2013.

It is

engaged in the business of Specialty Chemicals and Intermediates. The

products of the Company find application in

various sectors like

Pharmaceuticals, Agrochemicals, Specialty, Electronic Chemicals, Material

Sciences, High Performance Photography etc.

Aether’s business models

include Large Scale Manufacturing of Specialty Chemicals, Contract

Manufacturing and Contract Research and Manufacturing Services (CRAMS).

It is a leading CRAMS provider, built upon technology intensive and state-of-

art R&D and pilot plant facilities. All its R&D, pilot, CRAMS, and large-scale

manufacturing facilities can switch between

batch and continuous process

technology. It has a production capacity of 6,096MT as of 31

st

March 2021.

Positives: (a) Differentiated portfolio of market-leading products (b)

Focus on

R&D to leverage the core competencies of chemistry and technology (c)

Strong

and long-standing relationships with diversified customer base (d)

Synergistic

Business Models focused on Large Scale Manufacturing, CRAMS and Contract

Manufacturing (e)

Experienced Promoters and Senior Management with

extensive domain knowledge.

Investment concerns: (a) Business is

dependent on manufacturing facilities and

any shutdowns or slowdowns in manufacturing operations can have adverse

effect on company (b) Currently, AIL

derives majority of its revenue from top 20

customers (~73%) without having any long-term contracts with all of them

(c)

Non-Compliance and changes in regulations can adversely affect AIL’s business.

Outlook & Valuation: In terms of valuations, the post-

issue TTM P/E works out

to 75

.6x (at the upper end of the issue price band), which is reasonable

considering AIL’s historical top-line & bottom-line CAGR of ~50% and ~75

%

respectively over FY19-21. Further, AIL has diversified customer base, strong

financial track record and higher

ROE. Considering all the positive factors, we

believe this valuation is at reasonable levels.

Thus, we recommend a subscribe

rating on the issue.

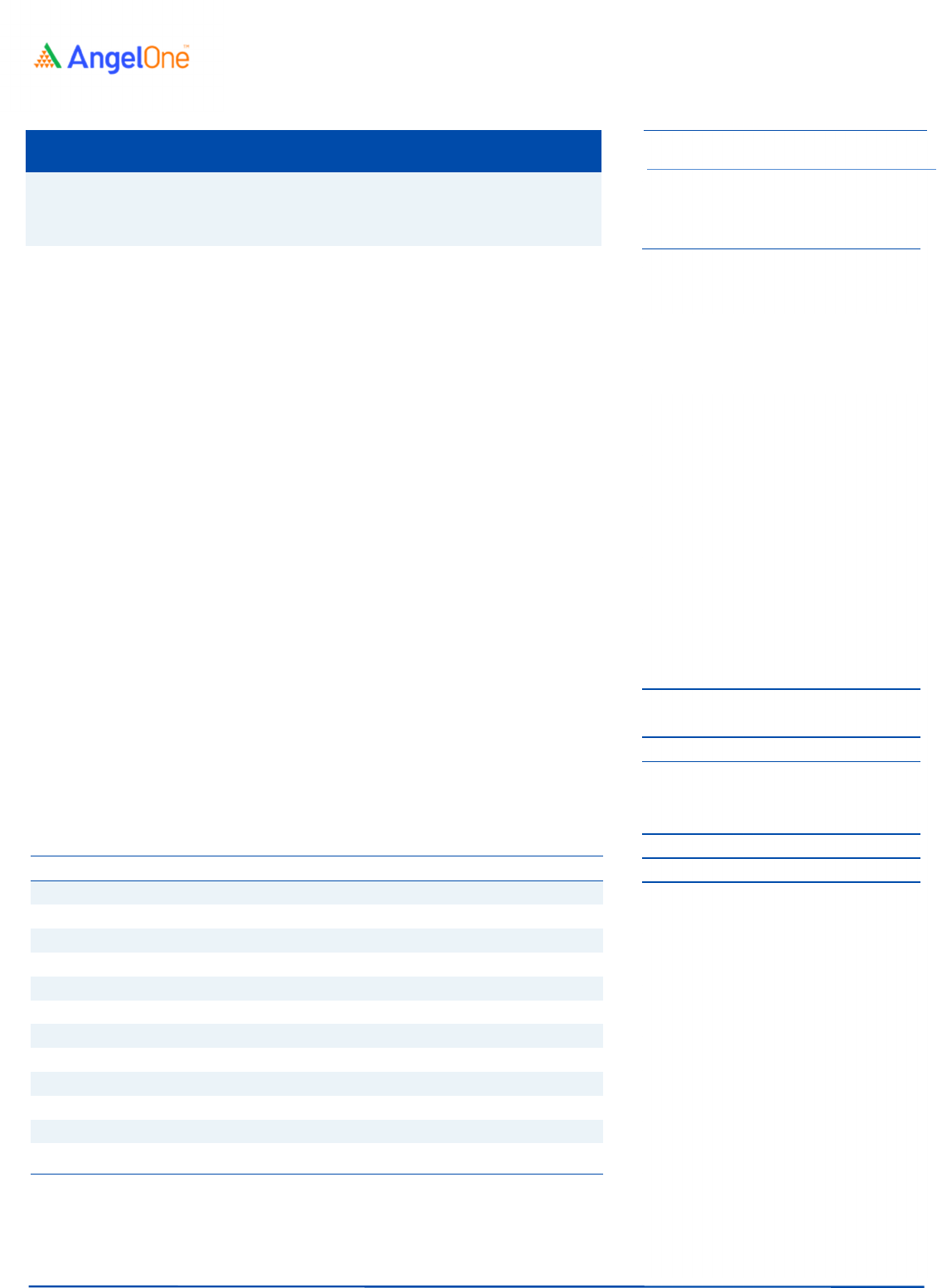

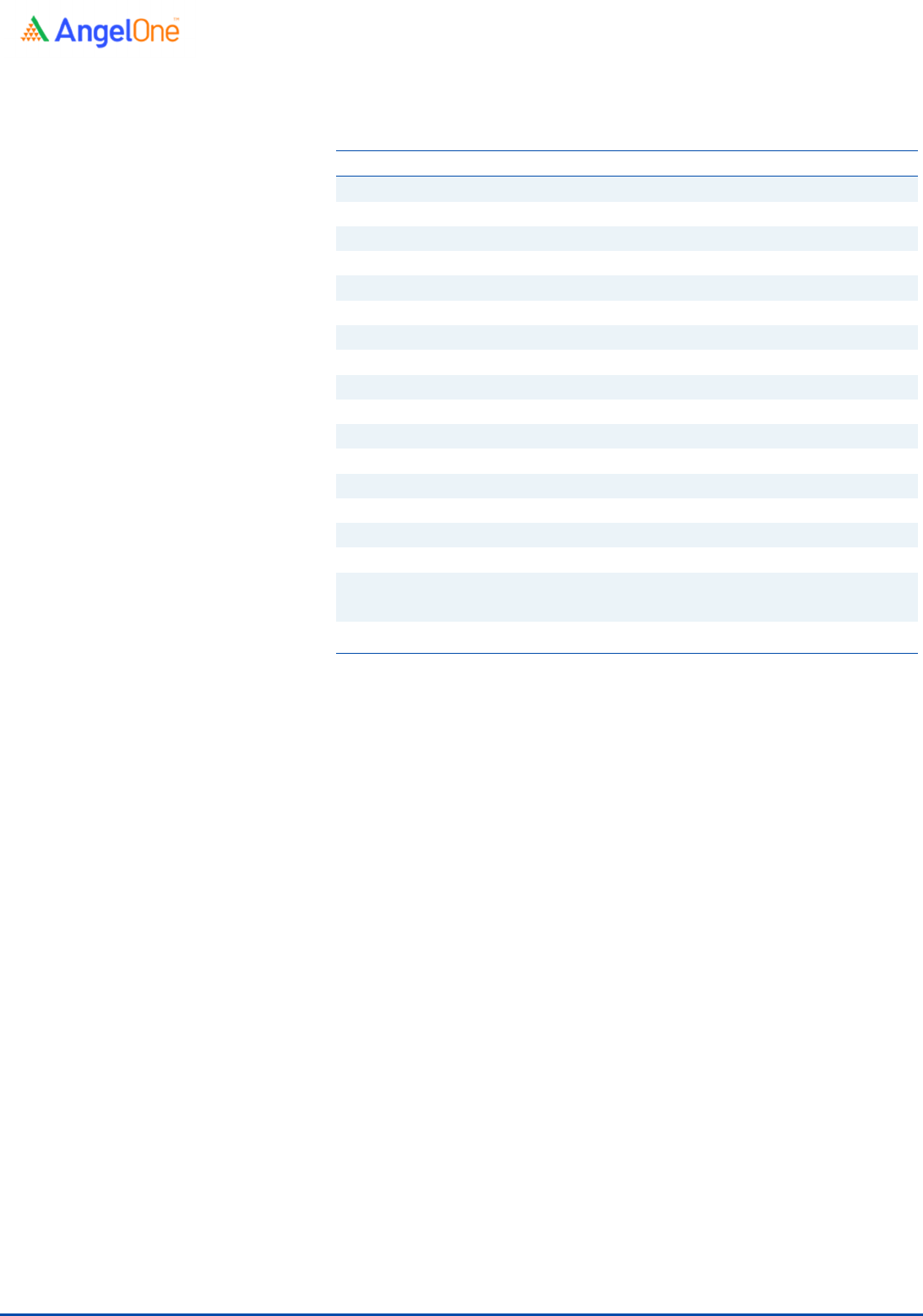

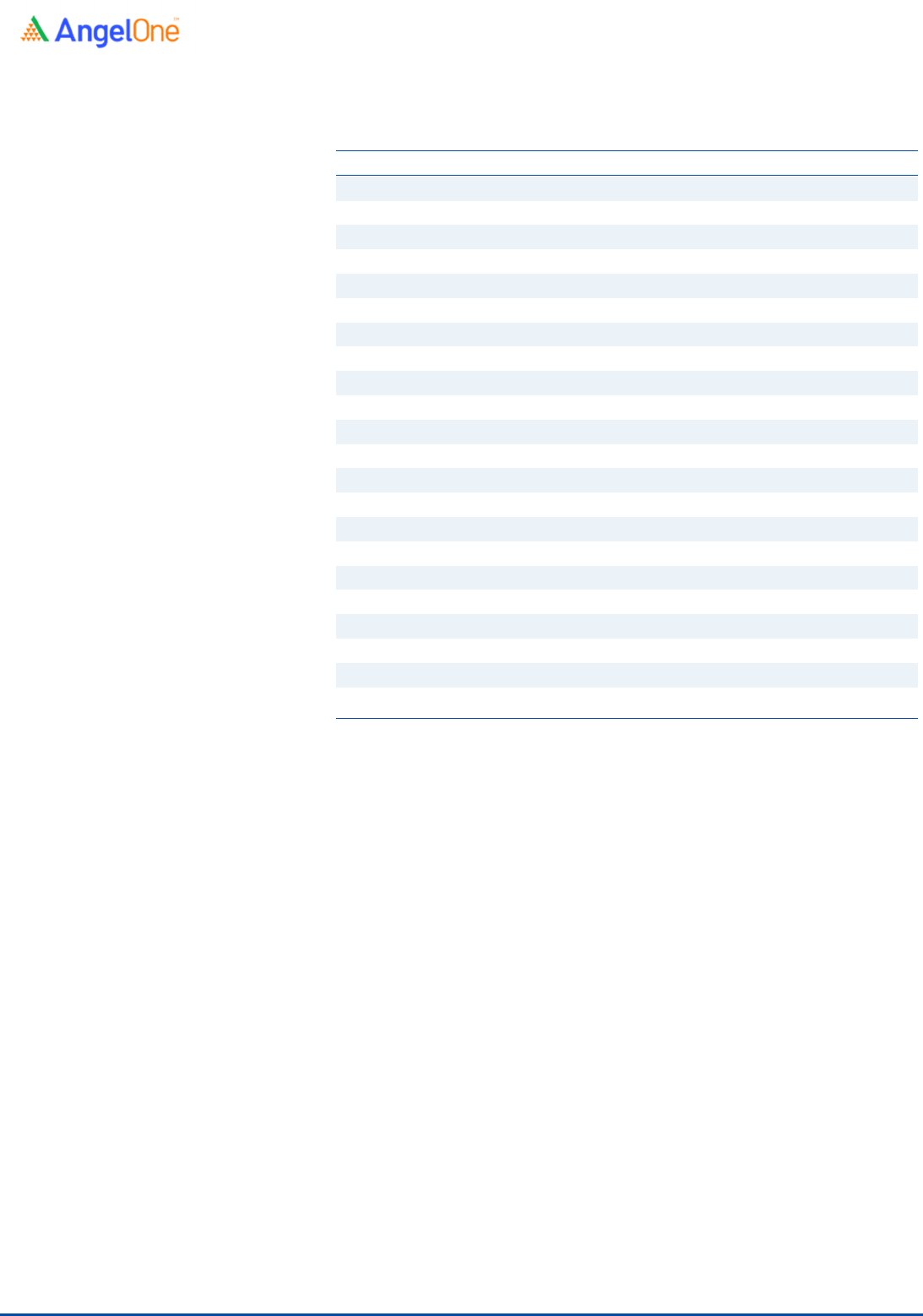

Key Financials

Y/E March (` cr)

FY2019 FY2020

FY2021

9MFY21

9MFY22

Net Sales

201

302

450

334

443

% chg

50.0

49.0

-

32.5

Net Profit

23

40

71

48

83

% chg

71.2

78.0

-

71.8

OPM (%)

23.6

23.8

24.9

22.9

28.5

EPS (`)

2.1

3.5

6.3

4.3

7.4

P/E (x)

310.0

181.1

101.7

-

-

P/BV (x)

187.7

92.4

41.5

-

-

RoE (%)

60.5

51.0

40.8

-

-

RoCE (%)

24.9

25.5

26.2

-

-

EV/Sales (x)

36.6

24.5

16.5

-

-

EV/EBITDA (x)

154.9

103.2

66.1

-

-

Angel Research; Note: Valuation ratios based on post-issue shares and at `642 per share.

Subscribe

Issue Open: May 24, 2022

Issue Close: May 26, 2022

Fresh Issue:

`627cr

QIBs 50%

Non-Institutional 15%

Retail 35%

Promoters 87.1%

Public 12.9%

Post Issue Shareholding Pattern

Post Eq. Paid up Capital:

`122.5

cr

Issue size (amount):

`808cr

Price Band:

`

610-642

Lot Size: 23 shares

Post-issue mkt.cap:

`

7,625*– 7,992cr**

Promoter holding Pre-Issue: 97.0%

Promoter holding Post-Issue: 87.1%

*Calculated on lower price band

** Calculated on upper price band

Book Building

Offer for sale:

`181cr

Face Value:

`10

Present Eq. Paid up Capital:

`112.69cr

Amarjeet S Maurya

Amarjeet.maurya@angelbroking.com

+022 4000 3600, Extn: 6810

Aether Industries Limited IPO

IPO Note |

Chemicals

May 23

, 2022

Aether Industries| IPO Note

May

2

3

, 2022

2

Company background

Incorporated on January 23, 2013, as a Public Limited Company. It is engaged

in the business of Specialty Chemicals and Intermediates. The products of the

Company find application in various sectors like Pharmaceuticals,

Agrochemicals, Specialty, Electronic Chemicals, Material Sciences, High

Performance Photography etc. Aether’s business models include Large Scale

Manufacturing of Specialty Chemicals, Contract Manufacturing and Contract

Research and Manufacturing Services (CRAMS).

It is a leading CRAMS provider, built upon technology intensive and state-of-art

R&D and pilot plant facilities. All its R&D, pilot, CRAMS, and large-scale

manufacturing facilities can switch between batch and continuous process

technology. It has a production capacity of 6,096MT as of 31st March 2021.

Aether is one of the fastest growing specialty chemical companies in India,

growing at a CAGR of nearly 49.5% between Fiscal 2019 and Fiscal 2021.

As of March 31, 2022, Aether’s product portfolio comprised over 25 products.

In CY2020, they were the sole manufacturer in India of 4MEP, MMBC, T2E,

OTBN, NODG, DVL and Bifenthrin Alcohol.

Issue details

AI

L is raising ₹181cr through OFS and ₹627cr through Fresh Issue

in the price

band of ₹610-₹642 per share.

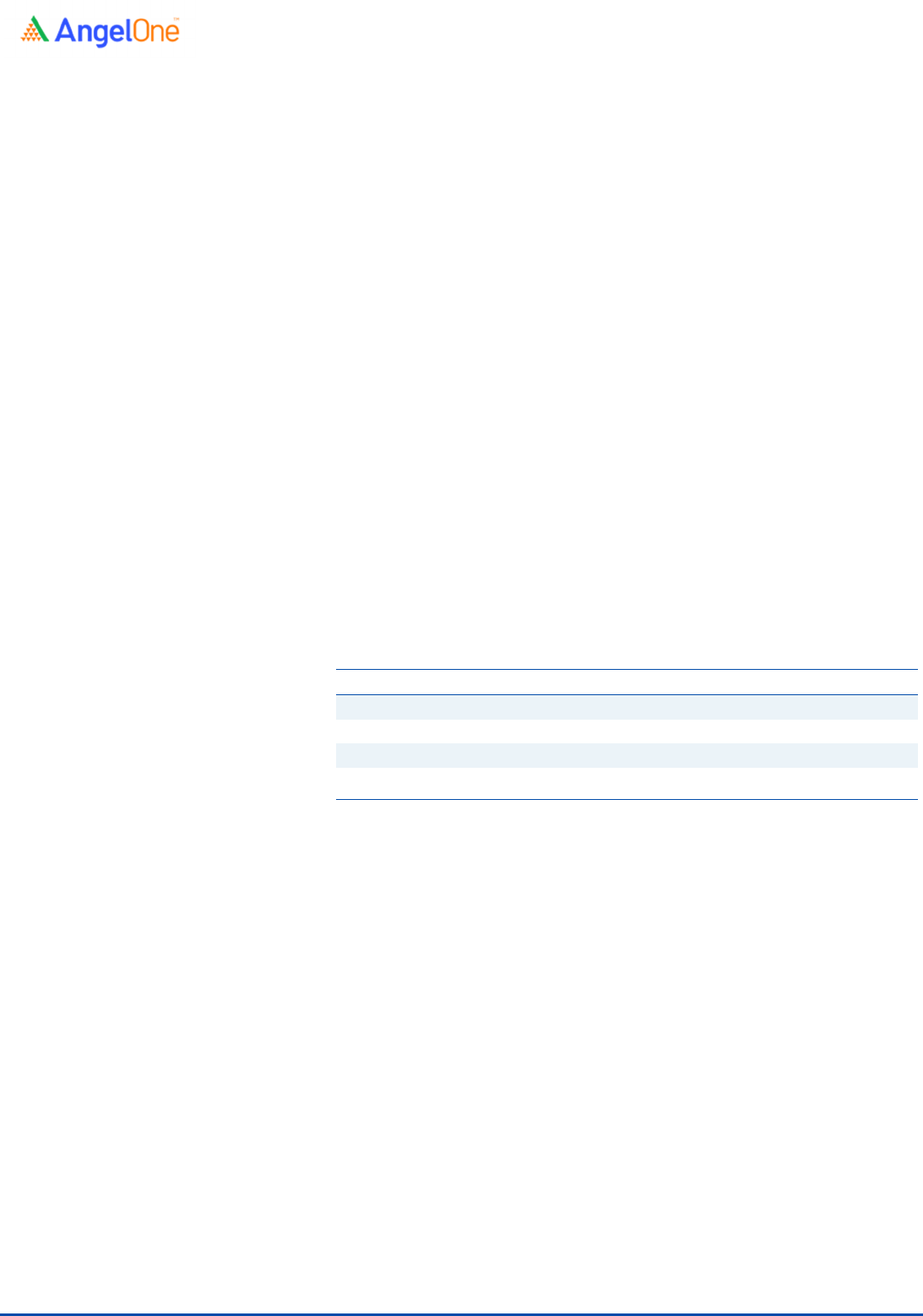

Exhibit 1: Pre and post IPO shareholding pattern

No of shares (Pre-issue) % (Post-issue) %

Promoter 11,12,36,127 97.0% 10,84,16,127 87.1%

Public 34,80,191 3.0% 1,60,66,546 12.9%

Total 11,47,16,318 100.0% 12,44,82,673 100.0%

Source: Source: RHP, Note: Calculated on upper price band

Objectives of the Offer

Prepayment or repayment of all or a portion of certain outstanding

borrowings availed by the Company (~₹138cr).

Funding capital expenditure requirements for the manufacturing facility -

Proposed Greenfield Project (~₹163cr).

Funding working capital requirements of the Company (~₹165cr).

General corporate purposes.

Aether Industries| IPO Note

May

2

3

, 2022

3

Profit & Loss Statement

Y/E March (` cr) FY2019 FY2020 FY2021 9MFY21 9MFY22

Net Sales

201

302

450

334

443

% chg

50.0

49.0

32.5

Total Expenditure

154

230

338

258

317

Raw Material

110

156

231

178

215

Personnel

11

13

22

16

21

Other Expenses

33

61

85

64

80

EBITDA

48

72

112

77

126

% chg

51.0

56.3

64.6

(% of Net Sales)

23.6

23.8

24.9

22.9

28.5

Depreciation& Amortization

6

8

11

8

11

EBIT

41

64

101

68

115

% chg

55.5

58.3

68.1

(% of Net Sales)

20.4

21.2

22.5

20.4

25.9

Interest & other Charges

11

9

11

8

10

Other Income

2

2

4

3

7

(% of PBT)

6.4

3.5

4.2

5.1

6.1

PBT

33

57

94

63

111

% chg

73.4

66.0

75.4

Tax

9

17

23

15

28

(% of PBT)

28.4

29.3

24.2

24.0

25.5

PAT

23

40

71

48

83

% chg

71.2

78.0

71.8

Basic EPS (Rs)

2.1

3.5

6.3

4.3

7.4

Source: Company, Angel Research

Aether Industries| IPO Note

May

2

3

, 2022

4

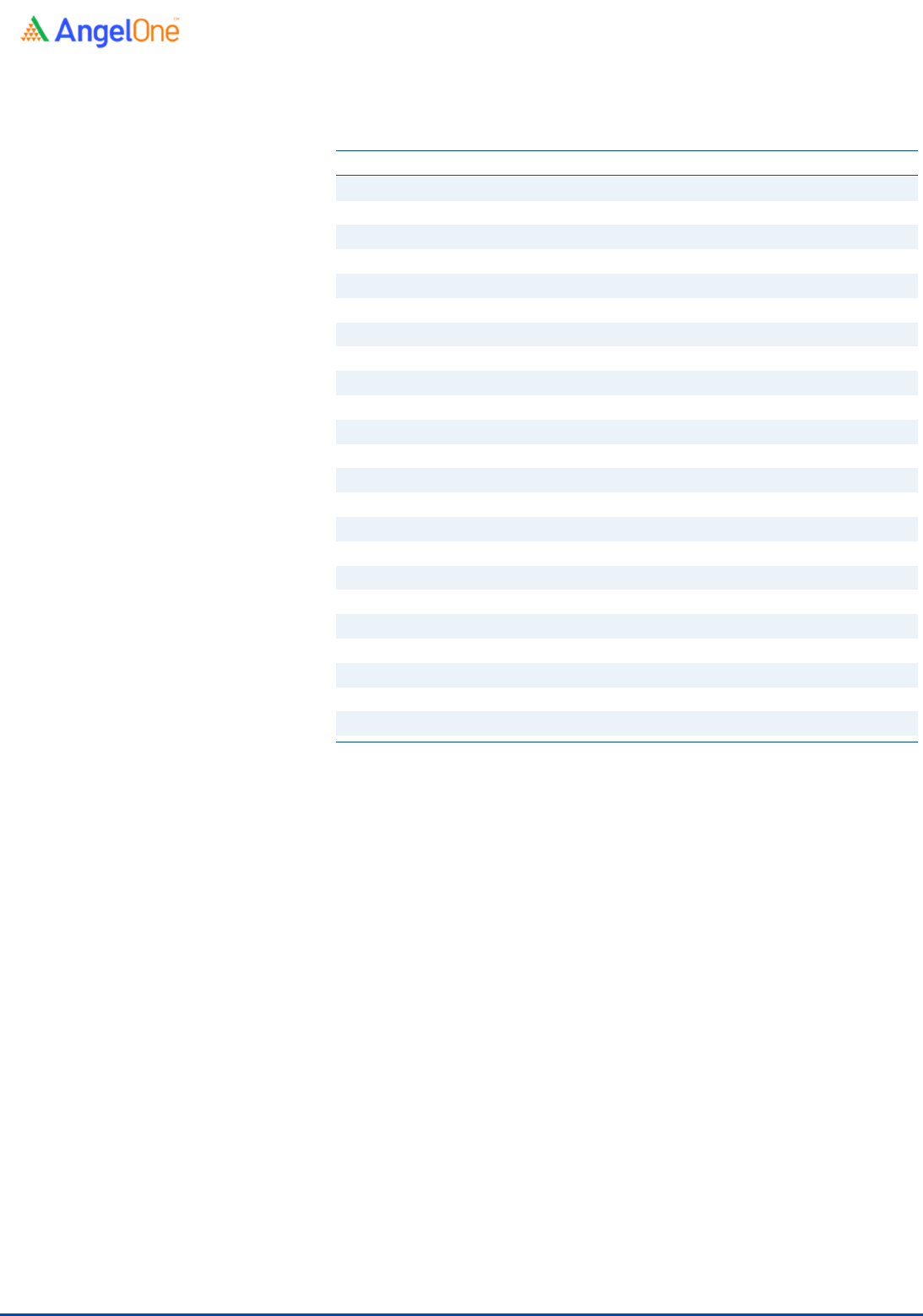

Balance Sheet

Y/E March (` cr) FY2019 FY2020

FY2021

SOURCES OF FUNDS

Equity Share Capital

9

9

10

Reserves& Surplus

30

70

164

Shareholders’ Funds

39

78

174

Total Loans

126

172

211

Other Liabilities - -

-

Total Liabilities

165

251

386

APPLICATION OF FUNDS

Net Block

106

129

216

Capital Work-in-Progress

1

17

0

Investments

0

0

22

Current Assets

96

148

211

Inventories

40

72

85

Sundry Debtors

48

63

108

Cash

1

4

6

Loans & Advances

1

1

1

Other Assets

6

9

12

Current liabilities

38

42

57

Net Current Assets

58

106

154

Deferred Tax Liabilities

3

8

10

Other Assets

3

6

3

Total Assets

165

251

386

Source: Company, Angel Research

Aether Industries| IPO Note

May

2

3

, 2022

5

Cash Flow Statement

Y/E March (` cr)

FY2019

FY2020 FY2021

Profit before tax

33

57 94

Depreciation

6

8 11

Change in Working Capital -

20

-43 -73

Interest / Dividend (Net)

10

9 11

Direct taxes paid -

6

-13 -20

Others

0

0 0

Cash Flow from Operations

23

18 23

(Inc.)/ Dec. in Fixed Assets -

12

-48 -77

(Inc.)/ Dec. in Investments

0

0 0

Interest Received

0

0 0

Cash Flow from Investing -

13

-48 -77

Issue of Equity

0

0 0

Inc./(Dec.) in loans

1

42 67

Dividend Paid (Incl. Tax)

0

0 0

Interest / Dividend (Net) -

11

-9 -11

Cash Flow from Financing -

10

33 55

Inc./(Dec.) in Cash

0

2 2

Opening Cash balances

1

1 4

Closing Cash balances

1

4 6

Source: Company, Angel Research

Aether Industries| IPO Note

May

2

3

, 2022

6

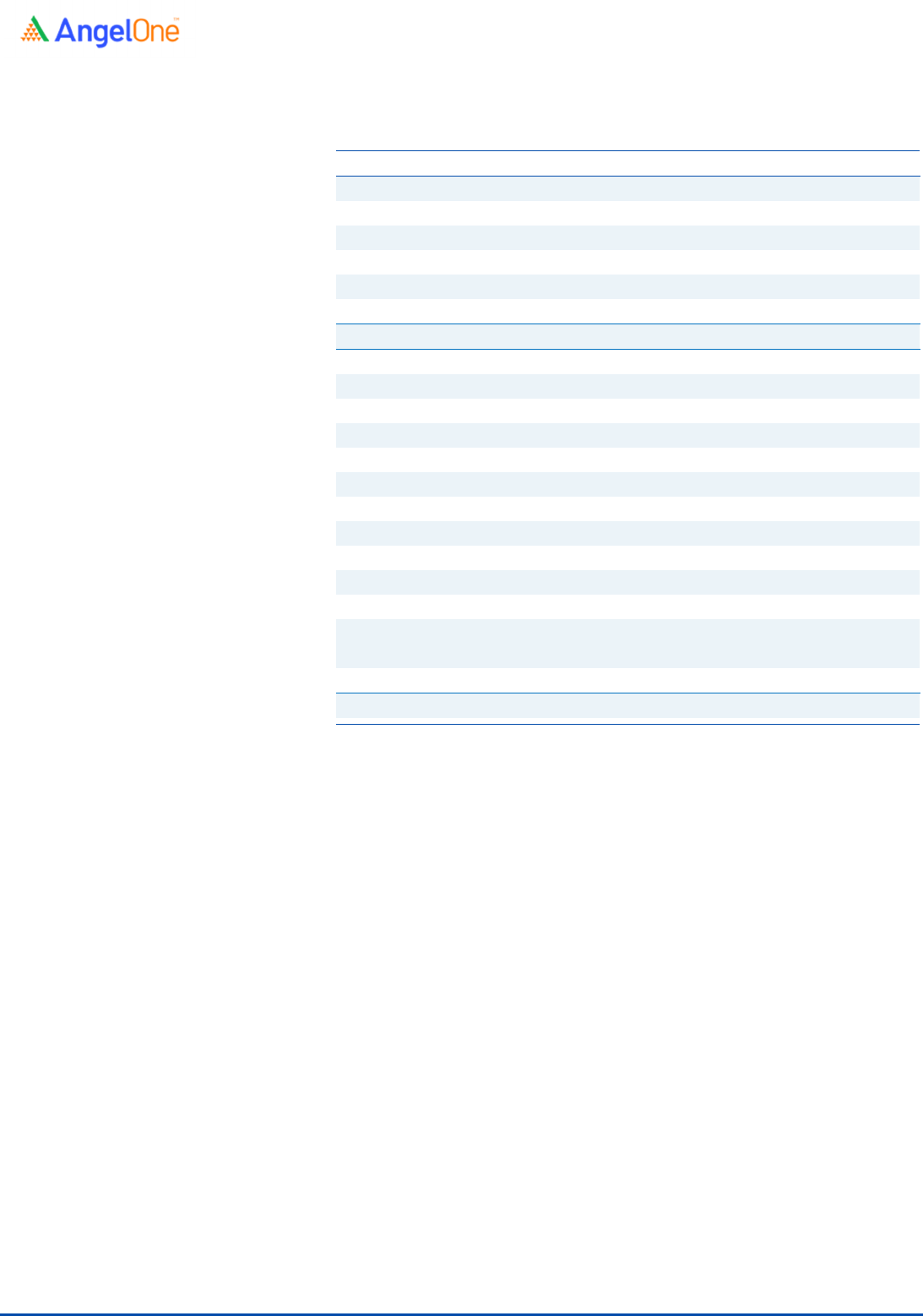

Key Ratios

Y/E March FY2019

FY2020

FY2021

Valuation Ratio (x)

P/E (on FDEPS)

310.0

181.1

101.7

P/CEPS

243.3

151.3

88.1

P/BV

187.7

92.4

41.5

EV/Sales

36.6

24.5

16.5

EV/EBITDA

154.9

103.2

66.1

EV / Total Assets

44.6

29.5

19.2

Per Share Data (Rs)

EPS (Basic) 2.07

3.55

6.31

EPS (fully diluted)

2.1

3.5

6.3

Cash EPS

2.6

4.2

7.3

Book Value

3.4

6.9

15.5

Returns (%)

ROCE

24.9

25.5

26.2

Angel ROIC (Pre-tax)

25.1

25.9

28.3

ROE

60.5

51.0

40.8

Turnover ratios (x)

Asset Turnover (Net Block)

1.9

2.3

2.1

Inventory / Sales (days)

72

87

69

Receivables (days)

87

76

88

Payables (days)

41

46

39

Working capital cycle (ex-cash) (days)

118

117

118

Source: Company, Angel Research

Aether Industries| IPO Note

May

2

3

, 2022

7

Research Team Tel: 022 - 40003600 E-mail: research@angelbroking.com Website: www.angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay Stock

Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and Portfolio Manager

and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One Limited is a registered entity with

SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates

has not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision.

Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such

investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in

this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an

investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of the subject

company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or its associates nor

Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve

months from the date of this report for services in respect of managing or co-managing public offerings, corporate finance, investment banking

or merchant banking, brokerage services or other advisory service in a merger or specific transaction in the normal course of business. Angel

or its associates did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection

with the research report. Neither Angel nor its research analyst entity has been engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading

volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals.

Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources

believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for

general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage

that may arise to any person from any inadvertent error in the information contained in this report. Angel One Limited has not independently

verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express

or implied, to the accuracy, contents or data contained within this document. While Angel One Limited endeavors to update on a reasonable

basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed

or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection

with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest in the subject company.

Research analyst has not served as an officer, director or employee of the subject company.